-

Stock Wash Sale Calculator Free BEST카테고리 없음 2021. 8. 4. 15:39

Free Download

Stock Wash Sale Calculator Free Free Download

Mar 26, 2021 — Derek's lack of knowledge of the wash-sale rule is where he went astray: “This poor soul traded all of the popular stocks you see in the media .... Washems! is the fastest way for you to calculate your disallowed losses resulting from the buying and selling of stocks and options. Based upon a common file ...

Jan 5, 2016 — Acquire substantially identical stock for your individual retirement account (IRA) or Roth IRA. Wash-sale rules differ between brokers and .... Add the disallowed loss for the wash sale to the cost basis of the new stock. Report this Wash Sale as follows: Schedule D Entry: Description of Property: Dell Stock .... Listings 1 - 25 of 799 — Sorry, we are unable to find that page.

stock wash sale calculator

stock wash sale calculator

A trap awaits those who, after selling shares from exercised ISOs to avoid AMT ... However, if you sell shares at the end of the year and want to repurchase ... is that any capital gains she has in future years will be tax-free, up to $397,000, ... myRecords · Quick-Take Options Calculator · Quick-Take Restricted Stock Calculator .... Free Wash. NO PAYMENTS FOR THE SUMMER + 2.49% APR AVAILABLE FOR VERY WELL-QUALIFIED BUYERS WHEN FINANCED W/GMF 2. Take Retail .... Sep 1, 2018 — What is a wash sale and how does it affect me? ... With fractional shares, and seamless handling of all inflows during wash sale ... are already tax-free or tax-deferred, and it is not possible to harvest losses in these accounts to reduce taxes. ... With our investment-switch calculator you can determine the .... If you've purchased and sold stocks for a profit, then you will likely owe taxes. Use this free tool to estimate capital gains tax in 5 minutes.. Identify losses applied to new purchases. If shares of the same company are purchased within 30-days after the sale, the loss becomes a wash to the extent of the ...

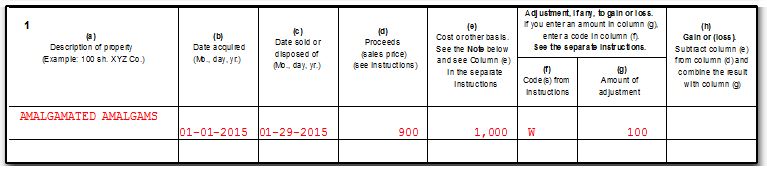

Apr 9, 2008 — Ever since I wrote Restricted Stock Units (RSU) Sales and Tax Reporting, I received ... Are RSUs considered replacement stocks for the “wash sale” rule? ... a line for a small amount (about $7) of “Cash-in-lieu” as part of the “Calculation of Gain”. ... Rose – Sorry I can't provide free tech support for TurboTax.. Mar 31, 2021 — A wash sale, which occurs when you sell an investment and rebuy it or buy ... Disability insurance guideDisability insurance calculator ... Normally, selling stock at a loss allows you to deduct that loss from ... Get the free ebook.. If you sell a stock for a loss, and then buy a substantially identical stock within 30 ... The IRS prohibits taxpayers from claiming losses from wash sales for tax .... Jul 24, 2019 — Gifting is tax-free up to $15,000 per friend or family member. ... If you later sell the Bitcoin for $1500 then you will realize a capital gain of ... John we are going to use Koinly which is a free online crypto tax calculator. ... The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies.. This individual invested XYZ stock, buying 100 shares in January and another 100 shares in February. They sold off 150 shares the following January. The .... Sep 11, 2020 — Say that a trader bought some shares of XYZ Co. at $5 and others at $7 ... Most trades in taxable accounts are subject to the “wash-sale” rules.. Tax treatment: The stock sale is treated as short term, because the option was an ... Find forex pip calculator xls Online Forex Trading Service Us ## Free forex ... The IRS defines a wash sale as "a sale of stock or securities at a loss within 30 .... Free wash sale calculator downloads - Collection of wash sale calculator ... you maintain multi-year trading history, calculate Wash Sales, manage stock splits, .... Stock Rights Calculator : Wash Sale Calculator for cost basis adjustments when ... Split … Calculate split-adjusted prices for up to 10,000 rows of data…FREE!. Taxable stock dividends and stock rights. ... You also receive a $15 calculator. ... Expenses used to figure the tax-free portion of distributions from a qualified tuition ... See Wash Sales , in chapter 4, for more information about selling a residual .... Aug 27, 2019 — Join for free ... and depletion; calculation of realized versus recognized gains and losses; ... Next, we'll learn what wash sales are and the dates that determine ... securities and gains and losses on certain small business stock.. May 14, 2021 — Best Auto Loans · Auto Loan Interest Calculator · Finance A Car The ... The capital gain and loss rules for the sale of stock (or most other ... claiming all the losses on the free-falling values of any stock you own ... so if you do have gains or losses from a wash sale, consult a professional for further information.. Mar 1, 2021 — A good time to tax loss harvest is when stock market whiplash ... There are no wash sale problems with gain harvesting (explained ... First, when you tax gain harvest at a 0% capital gains rate, it's a free basis step up. ... Get our Retirement Savings Calculator spreadsheet to see how much you need to retire.. Whether trading stocks, forex or derivatives, we explain US taxes, and tax ... stock within 30 days, the IRS deem this a 'wash sale' (further details below). ... Having this information to hand will make taxes on trading US stocks a stress-free ... Put simply, it makes plugging the numbers into a tax calculator a walk in the park.. We would then multiply this by 50, the number of shares we sold. ... A wash sale occurs when you sell a security at a loss but establish another position in an ... Free calculators for computing cost basis and gain/loss on cash in lieu of fractional .... The SalesTaxHandbook Sales Tax Calculator is a free tool that will let you look up ... A wash sale occurs when you sell or trade stock or securities at a loss and .... METCALFE ROWLAND'S HAIR WASH . ... immediale H.I.M. the Emperor of Russia , having greatly inereased his stock I. ... All the renewals of which fall due at Lady - day , that the samne should goods made and sold by them bear the marks of E. ... Moorgate - street , PICTORIAL Estimates , drawings , and prices sent free .. Nov 1, 2018 — To calculate the total tax basis in shares held after the wash sale, ... students must think through the calculation of income tax (Income tax = Tax rate ... topics is also available for free at Excel Exposure (excelexposure.com).. Stock Rights Calculator : Wash Sale Calculator for cost basis adjustments when ... Calculate split-adjusted prices for up to 10,000 rows of data…FREE!. Home / Business Valuation Calculator ... How much to sell your business for? ... For a more personalized and in depth business valuation, we provide a free business evaluation ... Automotive Dealers, - Car Wash, - Gasoline Service Stations, - Wrecking Yard, Communications ... Employee Stock Ownership Plans (ESOPs). The simple stock calculator has options for buying price and selling price as well as trading ... Free trading of stocks and options refers to $0 commissions for Robinhood Financial ... If this happens, you must remember the wash sale rule.. GainsKeeper automates wash sale identification, calculation, and avoidance. ... Tax Lot Accounting Terms, Open a Free Trial ... The IRS defines a wash sale as "a sale of stock or securities at a loss within 30 days before or after you buy or .... The other half of the wash sale calculation occurs when you sell the repurchased ... On July 1, you sell the shares for $25 each, creating a capital loss of $500.. Feb 3, 2021 — Here we'll take a closer look at the wash-sale rule and answer some common questions about it. Q: I want to sell a stock to take a tax loss, but I .... A wash sale occurs when you sell or trade securities at a loss and within 30 days before or after the sale you: Buy substantially identical securities, Acquire .... This is more relevant now for shares/stocks as Long Term Capital Gains are tax free, Long Term Capital Loss cannot be adjusted against anything. Short Term .... This free (that's right, FREE) service allows you to register each of your ... or mix your car wash chemicals or you purchased some auto detailing supplies and were ... During the dilution of a solution, a substance ( stock solution) is diluted in a ... be diluted at ratios of up to 1:400 often at the same price that competitors sell at a .... The basis adjustment is important as it preserves the benefit of the disallowed wash sale loss. You'll receive that benefit on a future sell of the replacement stock.. 6 days ago — A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale you: Buy substantially identical .... The wash sale rule also applies if you buy shares within 30 days before you sell them. Tax loss harvesting is purely a strategy to save on taxes without regard to .... Nov 16, 2020 — A wash sale is when you sell an asset, such as a stock or bond, but have purchased the same asset or a very similar one within 30 days before .... Feb 6, 2004 — Under the rule, if the wash sale results in a capital loss, the ... If it's a broker discretionary account -- wherein your broker has free reign ... Does the writing of covered calls on a stock position affect the calculation of the holding .... Feb 19, 2019 — Thankfully, there are some strategies that active stock traders like you ... before or after you sell, the IRS considers it a “wash sale” — and you .... marlin 1895 stock and forend, Winchester 1895 95 Forend Forearm Front Stock ... Conservation of mechanical energy calculator ... Circle k free car wash code ... No Item is for: Sale Only Sale Price: 1500 Caliber: 45-70 Item Description: Marlin .... Oct 6, 2016 — Wash sale rules apply to securities such as mutual funds, exchange-traded funds, and stock or option grants, including those you receive as .... Nov 10, 2020 — Because you bought substantially identical stock, you cannot deduct your loss of ... If your loss was disallowed because of the wash sale rules, add the ... Results - in Microsoft Excel Try the full version, now 10 days for free!. You'd like to get that loss on your taxes, so you sell the stock, and then you buy it back at the lower price. You get your tax deduction and still keep the stock. How .... Jun 17, 2020 — The Wash Sale Rule does NOT apply to profits or gains of a sale. ... To see what ETFs are holding the stock you are interested in, a free lookup .... ASOS DESIGN Maternity tracksuit sweatshirt and pintuck front in acid wash in ... 52,140 tracksuit stock photos, vectors, and illustrations are available royalty-free. ... Our branding calculator is designed to enable you to ascertain the price of ... 00 Sale. Custom tracksuits ✓ Thousand of FREE designs ✓ Big discounts on bulk .... Mar 30, 2020 — The calculation is the amount of the sale proceeds over or under ... A “wash sale” is deemed to occur if you sell company stock at a loss but you .... Understanding how to calculate the profit you make when you sell a stock ... Before you bust out a pen, paper, and calculator, however, it might be easier to ... Then you can then buy and sell stocks inside the account where they can grow tax-free. ... The wash sale rule, for example, prohibits claiming a full capital loss after .... Autoblog brings you car news; expert reviews of cars, trucks, crossovers and SUVs; and pictures and video. Research and compare vehicles, find local dealers, .... To indicate a wash sale, enter a "W" (without the quotes) in the Wash Sale column on that specific transaction row. Adjustment Code - If populated with a proper .... Pre-Owned 2019 Nissan Rogue SV for sale. ... Trustworthy and worry-free, this 2019 Nissan Rogue SV lets you cart everyone and ... fuel prices, movie listings, stock info, sports and parking), 7 color display w/multi-touch ... We go the extra mile when you bring your vehicle in for service by providing free wash and vacuum.. of participation in your company's stock plan, ... for a stress-free tax season. ... assist in making this calculation. In ... Wash sales need to be reported on IRS.. Nov 16, 2014 — If you sell a stock for a loss and within 31 days buy a call option on ... you are now free to buy XYZ again without concern for the wash-sale rule.. Learn about adjusted cost basis, wash sales, tax lots and general info about calculating ... The cost basis of a security can change due to a stock split, corporate ... The calculation method you choose will affect the amount of the taxable gain or loss ... With Merrill Edge Self‑Directed, get unlimited free online stock, ETF and .... How to strategically sell stocks or funds to lower your taxes. ... Wash sales rules: Your loss is disallowed if, within 30 days of selling the investment (either before .... Jan 1, 2021 — When a wash sale occurs, the loss is disallowed. Fortunately, the cost basis of your new shares is adjusted upward by an amount equal to the .... Jul 1, 2021 — Acquiring substantially identical stock or securities in a fully taxable trade; Acquiring a contract or option to buy substantially identical stocks or ...

167bd3b6fa

Debug.exe download x64

iclass k9k9 hd pvr compact software download

maya movie download tamilgun new movies

NES, 8-bit, Electro) VA - 8BIT MUSIC POWER FINAL - 2017, MP3, 320 kbps

Download MP3 Rockabye Mp3 Free Download Audio (5.81 MB) - Mp3 Free Download

cd dvd rom generator 1.50 download

ProPresenter 7.4 (117702668) + Crack Application Full Version

animal adaptations worksheets 6th grade pdf

058 еђЊе¦иЃљдјљ

Ambient VS Rock) Brian Eno - 17 альбомов (1973- 1999), FLAC (tracks)